Understanding Your Equitable Equi-Vest 403(b) Structured Investment Option (SIO)

If you're a teacher investing for retirement through your school’s 403(b) plan, you may have been presented with the Equitable Equi-Vest variable annuity and its Structured Investment Option (SIO). These “buffered” segments are often marketed as a way to capture market growth while limiting downside risk. But what are you actually getting?

This article will break down how the SIO works, what real-world outcomes can look like, and how it compares to simply staying invested in the market.

What Is the Structured Investment Option (SIO)?

The Structured Investment Option is an investment choice inside your Equitable 403(b) annuity. Instead of investing directly in the stock market, your money is placed into time-based “segments” that offer:

Cap Rate: The maximum gain you can receive, regardless of how well the market performs.

Buffer: Protection from a set amount of market loss.

Segment Term: A 1-year, 3-year, or 5-year holding period.

You’re essentially trading some upside for downside protection.

Real Cap Rates and Buffers (2025 Data)

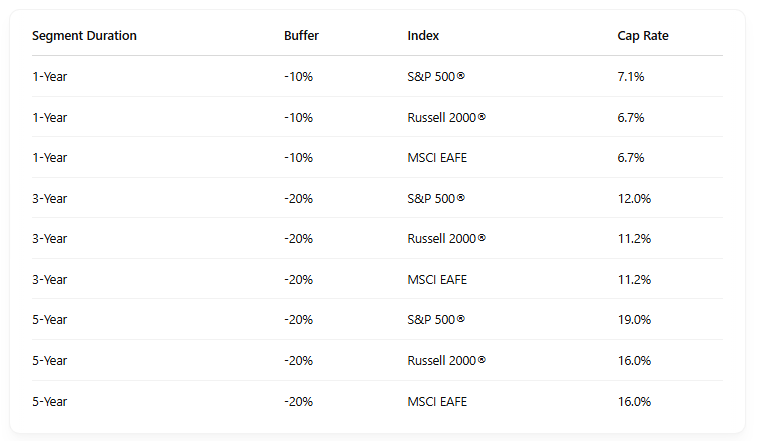

Here are the actual segment options currently available through Equitable’s SIO as of early 2025

How Do They Work?

Let’s say you choose the 1-year S&P 500 segment with a 7.1% cap and 10% buffer.

If the S&P 500 goes up 25% → You earn 7.1%, not 25%.

If the S&P 500 goes down 8% → You earn 0%, since the loss is within the buffer.

If the S&P 500 drops 20% → You lose 10%, because Equitable absorbs the first 10%.

So What Happens in Real Life?

Now let’s look at real-world examples using actual S&P 500 returns from the last three years: Source

2022: -18.11%

2023: +25.83%

2024: +25.66%

Let’s compare what happened if you invested in a regular S&P 500 index fund vs. the SIO across different timeframes.

Case Studies

1. Jane– Chose the 3-Year SIO with a 12% Cap

Jane started a 3-year SIO segment in January 2022, hoping for protection during volatile times.

The total S&P 500 return from 2022 to 2024 was about +30.01%.

Jane’s 3-year SIO capped him at 12.0% total return.

Average Annual Return:

SIO: ~3.86% per year

S&P 500 (actual): ~9.14% per year

Jane was protected in 2022 when the market dropped -18%, but she missed out on the huge rebounds in 2023 and 2024. Her returns were steady, but significantly lower than if she had stayed invested in the market.

2. Sophia – Rolled Over into 1-Year SIO Segments

Sophia used the 1-year S&P 500 SIO segments (7.1% cap / 10% buffer) and renewed annually:

2022: Market fell -18.11% → Sophia lost 8.11% (first 10% absorbed).

2023: Market up 25.83% → Sophia earned 7.1%

2024: Market up 25.66% → Sophia earned 7.1%

Average Annual Return Over 3 Years:

SIO: ~1.99% per year

S&P 500 (actual): ~9.14% per year

Sophia avoided the worst of 2022, but her capped upside meant she missed most of the gains in the strong rebound years.

3. Carlos – Stayed Fully Invested in the S&P 500 Index

Carlos opted not to use the SIO at all and instead invested in a low-cost S&P 500 index fund through his 403(b).

Over 3 years, his total return was approximately +30.01%.

Average Annual Return: ~9.14%

Carlos experienced the full drawdown of 2022, but also captured all the upside in 2023 and 2024. Long term, he came out ahead of both the SIO strategies.

Key Takeaways for Teachers

The SIO offers a cushion—helpful in down markets—but it's important to understand the cost: limited upside.

Over longer periods, the SIO often lags the actual market, especially if recovery years follow a decline.

There are no annual fees on SIO segments, but the “cap” is your hidden cost.

Market timing matters. If you lock into a capped return just before a bull market, you’ll underperform significantly.

Bottom Line

The Structured Investment Option can be a useful tool for those especially sensitive to market volatility—but it's not free. You trade peace of mind for potential growth.

If you're wondering whether the SIO is right for your goals, or if you've been surprised by low returns despite a booming market, it may be time for a full review of your 403(b).

Need help reviewing your current 403(b) allocation or SIO performance?