Converting Education Savings to Retirement Funds: A New Opportunity

The landscape of financial planning has evolved, offering families more flexibility in managing their education savings. Thanks to recent legislative changes, 529 education savings accounts can now serve a dual purpose, potentially boosting retirement savings for beneficiaries who don't use all their education funds.

Understanding the 529 Rollover to Roth IRA

The SECURE Act 2.0, passed by Congress in late 2022, introduced a game-changing provision for 529 account holders. Under certain conditions, beneficiaries can now roll over up to $35,000 from their 529 accounts into a Roth IRA, tax- and penalty-free. This new option addresses a common concern among 529 account holders: what happens to the funds if they're not needed for education?

Key Requirements for 529-to-Roth Rollovers

Before initiating a rollover, it's crucial to understand the following conditions:

The 529 account must have been open for at least 15 years for the designated beneficiary.

The Roth IRA must be established in the name of the 529 account's beneficiary.

The rollover amount, combined with other IRA contributions, cannot exceed the annual Roth IRA contribution limit for the beneficiary.

Only contributions (and their earnings) made at least five years before the transfer are eligible.

The lifetime rollover limit is $35,000 per beneficiary.

Benefits of the 529-to-Roth Rollover Option

This new provision offers several advantages:

Tax Efficiency: It allows for tax-free growth of unused education funds, now directed towards retirement.

Flexibility: Beneficiaries who choose alternative career paths or receive scholarships can still benefit from their 529 savings.

Avoiding Penalties: It provides a way to use excess 529 funds without incurring the 10% penalty typically associated with non-qualified withdrawals.

A Practical Example: Meet Mary

To illustrate how this works, let us consider Mary, a 22-year-old with $30,000 in her 529 account. Instead of attending college, she became a freelance graphic designer. Under the new rules, Mary's parents can gradually convert her unused 529 funds into a Roth IRA.

Rollover Strategy:

Annual Roth IRA contribution limit (2024): $7,000

Over five years, Mary can transfer the entire $30,000 to her Roth IRA

IRA Contributions Limit: $7,000 for 2024

Long-Term Impact

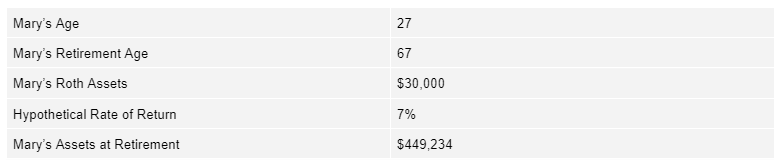

Assuming a 7% annual return, Mary's $30,000 Roth IRA balance at age 27 could grow to an impressive $449,234 by retirement at age 67. This demonstrates the powerful long-term benefit of this rollover option.

Mary's Roth IRA assets over time

Important Considerations

While this new provision offers exciting possibilities, there are some key points to keep in mind:

Income Considerations: Unlike regular Roth contributions, income limits may not apply to 529-to-Roth transfers, but this is subject to future IRS guidance.

Earned Income Requirement: It's currently unclear if the usual earned income requirement for IRA contributions applies to these rollovers.

State Tax Implications: Check your state's tax laws, as some states offer tax benefits for 529 contributions that may be affected by rollovers.

Conclusion

The 529-to-Roth IRA rollover option represents a significant enhancement in financial planning flexibility. It allows families to save confidently for education while providing a safety net for unused funds. However, as with any financial decision, it's crucial to consult with a qualified financial advisor or tax professional to understand how this strategy fits into your overall financial plan.Remember, while this new option is exciting, the primary purpose of 529 accounts remains funding education. The rollover provision simply adds an extra layer of financial security and flexibility for families planning for their children's future.

Prior to investing in 529 Plan investors should consider whether the investor's or designated beneficiary's home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state's qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing.

This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

Investing includes risks, including fluctuating prices and loss of principal. No strategy assures success or protects against loss.

Investment advice offered through Private Advisor Group, a registered investment advisor