An Independent Review of Monroe Woodbury CSD 403(b) Plan

Did You Know: Monroe-Woodbury has 21 different 403(b) providers to choose from?

This means that there are 21 separate companies with different sales/service reps that offer different investment products and varying fee structures.

So how do you know which of these 21 approved providers to use?

Did you do your homework before you signed up for your 403(b) Plan?

According to this CNBC article: Why these teachers’ retirement plans aren’t making the grade, a large percentage of educators that contribute to these plans are making a very costly mistake by selecting a high fee 403(b) provider on their school districts approved vendor list.

This CNBC article shares stories of school district employees like yourself that were being charged much higher fees before they got wise and made a change for the better.

Many school districts provide their employees with little to no education on these voluntary retirement plans. So, there is a good chance that most participants only heard about them from a salesperson that shows up in the faculty lounge that was selling their company’s proprietary product which could be larded with high fees and surrender charges.

The Cost of the Problem

Fees and costs you pay in your retirement savings accounts can really add up and not being aware of how these can have a detrimental impact on your retirement savings. To be clear, there will always be fees and costs associated with investing. Their mere existence is not the problem. The problem is the degree to which fees and costs can vary. You cannot remove all the fees but many of them can be reduced or totally avoided.

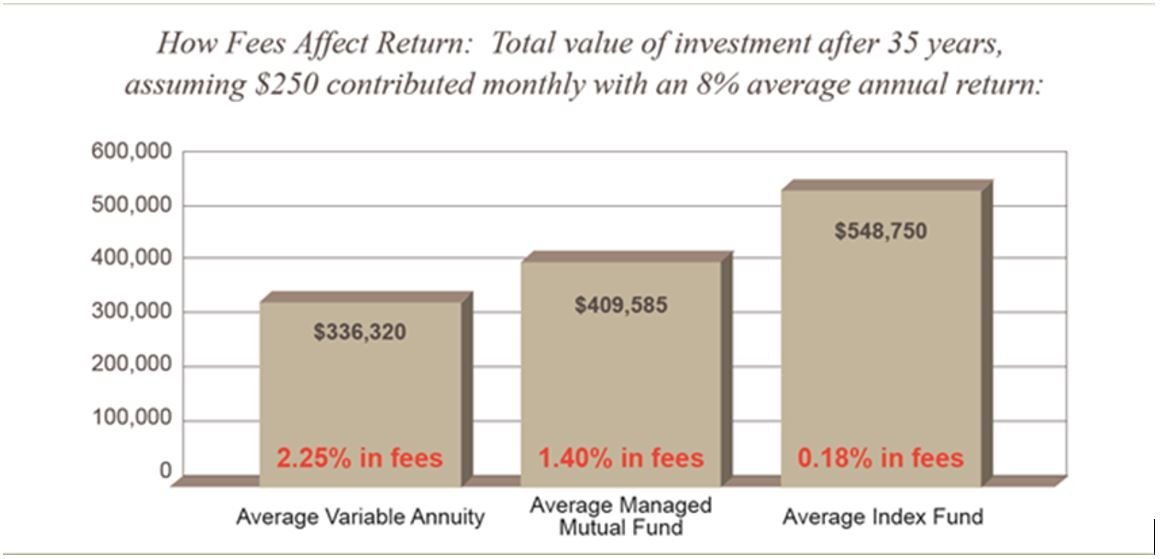

Let’s look at what a difference overpaying by 1-2% can have on your retirement savings over time.

An extra 1-2% may seem insignificant when considering a one-time purchase but when these small percentages are applied to your retirement savings annually the difference can add up. The chart below illustrates the difference in the total value of investments after 35 years.

That is a difference of over $200,00!

So how can you lower your fees by 1-2%? First, you must understand all of your investment choices and the providers that give you access to them.

Monroe-Woodbury CSD 403(b) Plan: Investment Choices

There are a wide range of investment choices available within the Monroe-Woodbury CSD 403(b) plan. A 403(b) plan allows you to make contributions into two types of investment products – Mutual Funds and/or Annuities.

So, you’ll first need to have a basic understanding of the differences between these two investment options and the fees that come along with them.

-

As a participant in a 403b retirement plan, it is important to understand what a mutual fund is and how it works. A mutual fund is essentially a basket of investments, such as stocks and bonds, that are managed by a professional investment company. When you buy a mutual fund, you are pooling your money with other investors to buy a diversified portfolio of assets. This diversification helps to reduce your risk, as you are not relying on the performance of a single stock or bond. However, it is important to remember that all investments involve some level of risk, including the possibility of losing your principal investment. Therefore, it's essential to carefully consider your investment goals and risk tolerance before investing in mutual funds or any other type of investment.

-

An annuity is a contract between you and an insurance company that requires the insurer to make income payments to you, either immediately or in the future. While annuities can offer some benefits, such as guaranteed income for life and tax-deferred growth, they may not always make sense for participants in a 403b retirement plan. This is because both annuities and 403b plans already offer tax advantages, so investing in an annuity does not provide any additional tax benefits. Additionally, annuities often come with high fees and complex features, such as surrender charges and long-term contracts, which can make them less attractive to investors. Before investing in an annuity, it's important to carefully consider your financial goals and weigh the potential benefits and drawbacks of this type of investment.

Monroe-Woodbury CSD 403(b) Plan: Provider Choices

Monroe-Woodbury CSD allows you to choose a 403(b) plan provider from a list of 21 approved investment providers. There are some excellent choices available on your school district’s menu, but many participants you have not been given the proper information to distinguish for the good from the bad providers.

Researching these 21 different companies can be a daunting task even for a seasoned financial advisor. You need to gather all the necessary information to identify what product they are offering and the costs that come along with it. Often, the costs of these investments are not transparent, and commissions earned by financial salespeople are not disclosed.

So how do you know who to trust with your retirement savings? First, we would recommend working only with financial advisors that are held to a Fiduciary Standard and are legally required to act in you best interest.

Next you should have a clear understanding of the fees that you are being charged because they have a negative impact on the returns in your 403(b) account because they cut directly into your annual rates of return. The good news is that many of these fees are avoidable or can be dramatically reduced.

Let’s zoom in on the various fees that these providers may charge to see which ones you can avoid and /or reduce.

For a mutual fund held in a retirement plan, these fees can include:

-

It costs money to run a mutual fund, sometimes more than others. This expense, also known as a management fee or operating expense, is typically deducted from the fund’s total assets before your share price is determined.

-

On certain mutual funds, you will pay an upfront fee sometimes called a “front-end load”. Depending on the amount of your investment, you could qualify for a lower upfront fee called a “breakpoint”.

-

A deferred sales charge (DSC), also known as a back-end load, is a commission paid by unitholders when they sell mutual fund units. Paying a DSC is an alternative to paying an upfront commission, or front-end load, at the time of purchase

-

Mutual funds are designed to be long-term investments, so trading fees were created for some funds to discourage short-term trading.

-

Many funds have an ongoing service fee that is paid to a financial advisor or the firm he or she works for as compensation for marketing the fund. Just like the expense ratio, this service fee will be deducted out of the total fund assets before your share price is determined.

For an annuity within a 403(b) plan, fees can include the following:

-

Also known as the Death Benefit. Participants pay the mortality and expense (M&E) fee each year to an insurer to offset the risk of investment loss, plus fees involved to pay annuity provider expenses. According to the Securities and Exchange Commission, that generally means an average of 1.25 percent annually, which equates to $250 a year on a $20,000 account. (Read our recent blog post for more on this).

-

These can be flat fees or a percentage of an account (typically, 0.15 percent, or $30 for a $20,000 account).

-

These are sales commissions an investor typically pays up-front when buying an annuity. These costs cut directly into the actual amount available to invest. For example, a 7 percent fee on a $10,000 investment will cost $700, meaning you’ve effectively only invested $9,300. These are common in 403(b) plans.

-

Inside a variable annuity, the underlying stock and bond investment choices, called sub-accounts, will have an investment management fee which can range from .25 – 2.00% of the value in that account per year.

-

These will apply if you sell an annuity within a certain period of time, known as the surrender period, which can last up to 15 years after purchase. This charge, also called a Contingent Deferred Sales Charge (CDSC), is a percentage of the asset balance at the time a person withdraws or transfers and depends on how long the money has been in place.

-

Special features offered by some variable annuities, such as a stepped-up death benefit, a guaranteed minimum income benefit, or long-term care insurance, often carry additional fees and expenses.

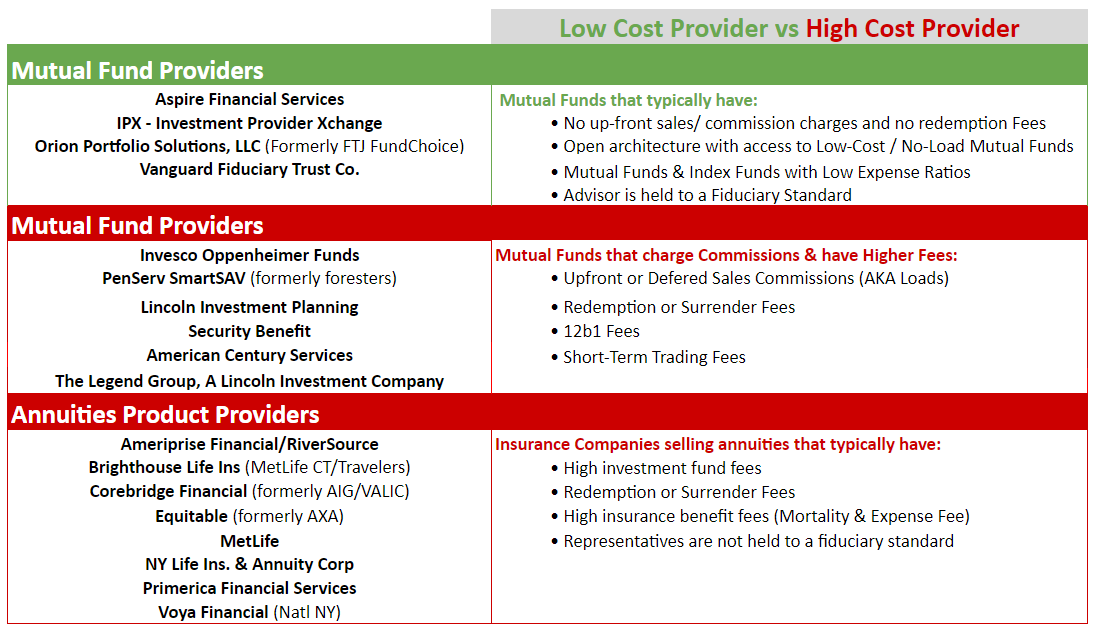

Below is a table detailing the vendors at Monroe-Woodbury CSD and the types of fees they charge. The Annuities Product Providers and Mutual Fund Providers in red are a ‘Fail’ due to the drawbacks listed below. Conversely, the Mutual Fund Providers in green are a ‘Pass’ due to the benefits described below.

Monroe-Woodbury Central School District Approved 403(b) Provider List

In Closing

Educators working in public schools have more retirement options available to them compared to those in the private sector. To ensure you make the right decisions, it is important to ask questions and seek advice from advisors who are available to help you become better informed about your investments. It is crucial to understand how your advisor is paid and whether they are obligated to act in your best interest.

Make sure you know if your advisor is held to the fiduciary standard of care when making recommendations. Analyzing your retirement investments can be overwhelming but reviewing it in smaller segments will make it more manageable. If it has been over a year since you reviewed your plan, it is probably time to take another look. Do not forget, asking questions is the key to learning and making informed decisions.

Feeling overwhelmed? We can help.

Our firm is an independent advisory firm that specializes in K-12 retirement plans. We are held to the fiduciary standard, and we don’t earn commissions from the recommendations that we make to our clients.

If you would like to schedule a free, no-obligation consultation to see if we can shed some light on your situation please contact us to schedule an appointment now or call us at (845) 981-7300.

Our firm has partnership agreements with Aspire, IPX, Vanguard & Orion Portfolio Solutions, which are available on the Monroe-Woodbury CSD’s 403b Omni Provider list .

Disclaimer

Please note that the information presented in the article about the Monroe-Woodbury CSD 403(b) plan is derived exclusively from publicly accessible sources, as well as other media outlets. It's imperative not to make investment or financial planning decisions solely based on this article. Instead, consult your benefits team, tax advisor, and financial professional to assess your specific circumstances.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

Fixed and Variable annuities are suitable for long-term investing, such as retirement investing. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 ½ are subject to a 10% IRS penalty tax and surrender charges may apply. Variable annuities are subject to market risk and may lose value.

No strategy assures success or protects against loss.

Investing in mutual funds involves risk, including possible loss of principal. Fund value will fluctuate with market conditions and it may not achieve its investment objective.

Investment advice offered through Private Advisor Group, a registered investment advisor.