K-12 Wealth Report - October

"Someone is sitting in the shade today because someone planted a tree a long time ago." - Warren Buffett

The Markets

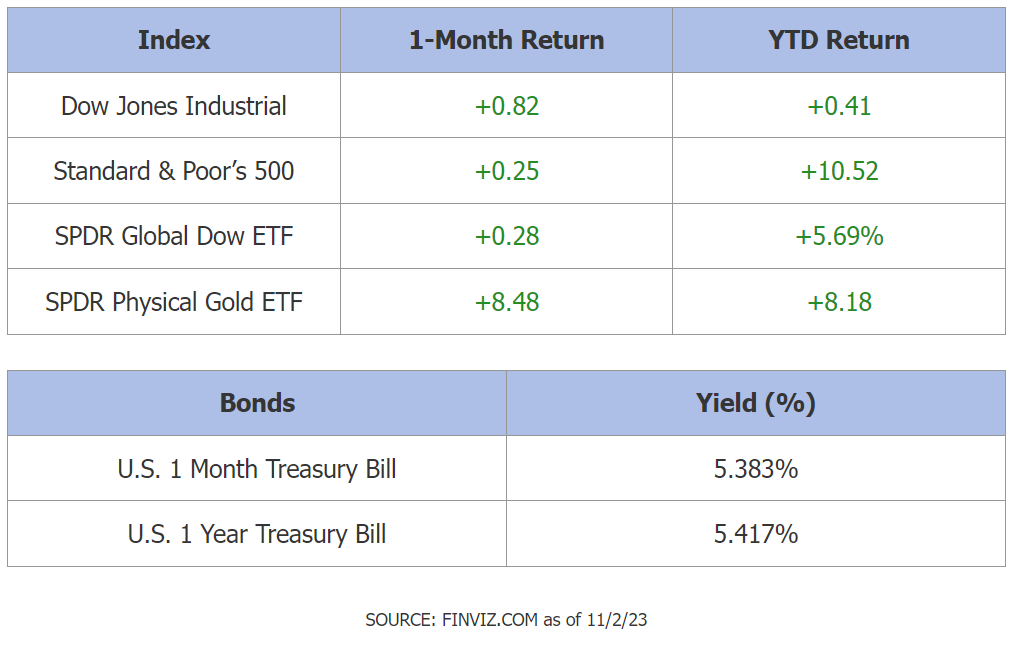

US stocks have just experienced their third consecutive losing month, a trend not seen since the start of the COVID pandemic in March 2020. In October, the S&P 500 dropped 2.2%, entering correction territory with a 10% decline from its July peak.

This decline is partially attributed to the Federal Reserve's stricter policy stance, leading to higher yields and lower stock prices. Treasury yields are at a 16-year high, causing concerns about increased debt costs and their impact on business development and the economy. Additionally, rising global tensions and a potential government shutdown in Washington add to the uncertainty.

Despite these challenges, historically, the S&P 500 experiences an average annual pullback of 14.3%, and it currently sits at around 4,150, needing to fall to 3,950 to align with this historical average.

While higher yields have affected stocks, third-quarter earnings remain strong, and the US economy is resilient. This year's market fluctuations have also made valuations more attractive to investors.

Furthermore, historical data shows that in the five previous instances since 1952 when the S&P 500 dropped in August, September, and October, the index averaged a 4.5% return over the final two months of the year, with only December 1957 resulting in a negative return.

Did You Know?

Teachers, did you know that you might be eligible for the Teacher Loan Forgiveness Program? This valuable federal program can help you reduce or even eliminate your student loan debt. To qualify, you typically need to work in a low-income school or educational service agency for at least five consecutive years. It's a significant benefit that can lighten your financial burden while you continue to inspire young minds in the classroom. Don't miss out on exploring this option to alleviate your student loan stress.

Get Retirement Ready

A carefully crafted financial plan ensures that individuals can maintain their desired lifestyle during retirement, despite the shift from a regular paycheck to relying on savings and investments. It serves as a roadmap for managing expenses, maximizing income streams from pensions, social security, and investments, and safeguarding against unexpected financial challenges. Moreover, a financial plan allows retirees to make informed decisions about when and how to access retirement accounts, optimize tax strategies, and plan for potential healthcare costs.

In essence, a sound financial plan provides the confidence and financial freedom needed to enjoy a fulfilling and worry-free retirement. If you're ready to embark on this journey to preserve your financial future, use this link to access our complimentary planning software and upon completing the process, you will automatically have access to the Balance Sheet, Liquidity, and Budget screens under the Dashboard.

Are You Paying The Death Benefit Fee?

Do you know if the Death Benefit Fee is killing the growth of your 403(b) retirement plan? This fee can significantly erode your retirement savings over time, and many individuals are unaware of its presence. To shed light on this hidden cost, we've created a video to help you understand the impact of the Death Benefit on your financial security. By watching the video, you can take proactive steps to safeguard your financial future and prevent this fee from draining your hard-earned nest egg.

by Ken Ford on October 4, 2023

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking professional advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

Investing includes risks, including fluctuating prices and loss of principal. No strategy assures success or protects against loss. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.