K-12 Wealth Report - August

In our commitment to keeping our subscribers well-informed about the financial markets and up-to-date on timely financial topics, I'm excited to announce the launch of our monthly email commentary, the K-12 Wealth Report. This concise and engaging newsletter will be delivered to your inbox early each month, offering insights into the markets and other intriguing financial planning content.

We are confident that you will find the newsletter both enjoyable and informative. However, if you wish to be removed from our email list, please use the link at the bottom of this email to unsubscribe. On the other hand, if you'd like to share this valuable resource with friends and colleagues, simply click the hyperlink below to provide us with their contact information.

“An investment in knowledge pays the best interest.” -Benjamin Franklin

The Markets

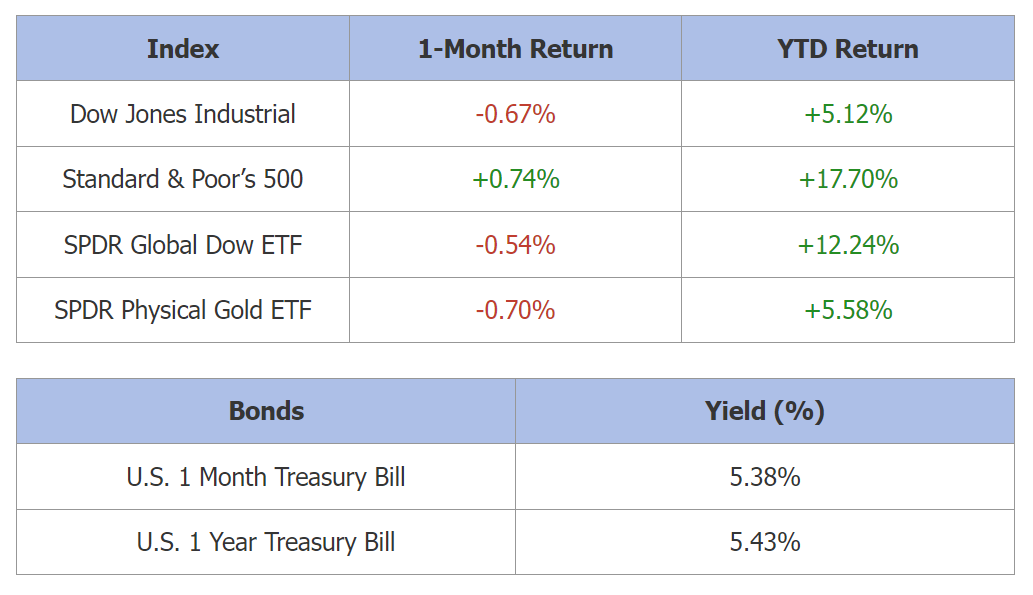

In August, the stock market displayed a dynamic and somewhat volatile performance. Throughout the month, investors remained watchful of global economic indicators and geopolitical events, which influenced market sentiment. Positive corporate earnings reports from technology giants and strong consumer spending helped buoy the market at times. However, concerns about inflation, potential interest rate hikes, and ongoing trade tensions also created periods of uncertainty. Overall, August saw a mix of gains and losses, underscoring the importance of a diversified portfolio and staying attuned to both domestic and international factors when navigating the markets.

Retirement Tip

Consider the advantages of a Roth 403(b) plan when planning for your retirement. This article provides a thorough and complete explanation of the Roth 403(b) plan, covering all essential aspects, including its benefits such as tax-free withdrawals, flexible distribution options, and exemption from required minimum distributions (RMDs). Assess your tax situation and long-term financial goals to determine if incorporating a Roth 403(b) plan aligns with your strategy, potentially leading to tax savings and increased control over your retirement income.

Tax Tip

If you're a teacher, remember that you have the opportunity to claim up to $300 for school-related supplies you've bought. While it might seem modest compared to your actual expenses, every bit counts in the realm of taxes. Be sure to keep those receipts handy. Learn More

Interesting Fact

Andrew Carnegie's philanthropic vision and financial support were instrumental in the establishment of the Teachers Insurance and Annuity Association (TIAA) in 1918, which provided teachers with retirement income and insurance options. This initiative later evolved into the 403(b) retirement savings plan, offering tax-advantaged savings for educators and nonprofit employees, leaving a lasting legacy of financial security for those dedicated to the field of education.

by Ken Ford on September 5, 2023

P.S. Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking professional advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

Investing includes risks, including fluctuating prices and loss of principal. No strategy assures success or protects against loss. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.